Feb 17 Legal Update

Top stories

Two new rulings on “disclosure of inside information”

(i) Market Misconduct Tribunal (“MMT”) delivered ruling for the Yorkey case (SFC press release; full MMT report),

What you should know:

- Nature: delay in disclosure of material deterioration in performance

- The company’s previous statement in 2012 interim report: “significant growth and increasing profitability for 2 H”

- Monthly management accounts made available to former CEO (but not to former Financial Controller and Company Secretary (“FCCS”)): deterioration should have been apparent by the November accounts (mid-Dec 2012); or latest when full-year management accounts were available (mid-Jan 2013)

- Draft full-year financial statements prepared by auditors (end of Feb 2012) made available to FCCS

- Company in breach: did not make disclosure till the annual results publication (end of Mar 2013); and share price dropped by 21.25% over the next three days

- Internal controls deficiency: no system in place to ensure inside information relating to company performance be identified and disclosed

- The two “officers” found liable for (i) “reckless” conduct causing the company’s breach; (ii) failure to set up the system to prevent the breach

- Fine: $1m against each of the company and CEO

- Disqualification orders (CEO: 18 months; FCCS: 15 months; as a director or take part in the management of a listed company or specified corporation)

- HKICPA recommended to make a disciplinary action against FCCS — a CPA and was responsible for ensuring the company’s compliance; training order also imposed

What you should do/watch out for:

- Internal controls — must have in place a system, to ensure inside information relating to company performance be identified and disclosed in a timely manner

- Why higher penalties than in the first MMT case (AcrossAsia case – Click: our Nov 16 update) — defendants found “reckless” rather than “negligent”; defendants’ conduct (circumstances of making admissions indicate “lack of remorse”); 13-week delay in disclosure (from mid-Dec 12 when Nov management accounts were available); investor loss attributable to such delay

(ii) MMT found defendants in the Mayer case guilty (SFC press release; full MMT report),

What you should know:

- Nature of four items of “inside information”: “outstanding audit issues”; “potential qualified audit report”; resignation of auditor; significant prepayment (totaling US$14m) underlying auditor concerns

- Found guilty — the company, as well as ten “officers” — management (chairman and executive director, executive director, company secretary and financial controller), and non-executive directors (including audit committee chair) at the relevant time

- The company had no written guidelines and/or internal controls policies regarding the compliance with disclosure of inside information

- Penalty orders to be delivered in March

What you should do/watch out for:

- This case reinforces the significance of having adequate internal controls systems regarding disclosure of side information

- Watch out for our update and analysis of penalty orders to be made

Regulators

(i) SFC is active in pursuing a range of remedies under court proceedings (s. 214, Securities and Futures Ordinance), pursuant to the theme of combating corporate misfeasance

What you should know/watch out for:

- Obtained “director’s disqualification” order (12 years) and “compensation” order ($84m) against former chairman of First Natural Foods Holdings Limited (embezzlement of fund, and provision of false bank statements to auditors)

- Seeking “disqualification” and “compensation” orders against former chairman of Kong Sun Holdings Limited and China Sandi Holdings Limited (concealment of his interests, so as to obtain shares at a discount in the company’s share placement to independent parties)

(ii) HKEX announced revised themes for enforcement of the Listing Rules and published a revised policy statement on its approach to enforcement (Click: Press Release)

What you should know/watch out for:

- Enforcement themes:

(i) (same as before) directors’ fiduciary duties, failure of issuers and directors to co-operate with HKEX’s investigations

(ii) (refined) financial reporting — delays, internal controls and corporate governance issues

(iii) (refined) delayed trading resumption — also covers prolonged “trading halts”

(iv) (new) inaccurate, incomplete and/or misleading disclosure in corporate communication

(v) (new) failure to comply with procedural requirements for notifiable/connected transactions

(vi) (new) repeated breaches of the Listing Rules

- Revised Enforcement Policy Statement published, reflecting administrative changes to reflect current practice and to bring the statement up to date (last revised in 2013)

(iii) HKEX Enforcement action: Datang International Power Generation Co Ltd and certain former directors (executive directors and a non-executive director) censured/or criticized, for failure to comply with the disclosure and shareholder approval requirements regarding certain “connected transactions” (Click: Press Release).

What you should know:

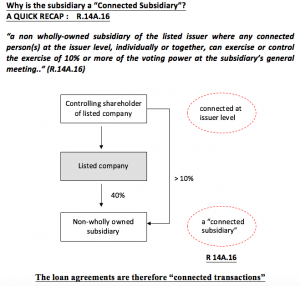

- The company entered into a series of entrusted loan agreements with a non-wholly owned (40%) subsidiary (amount: RMB 3,402m)

- Before the first agreement, a shareholder of such subsidiary (over 10% interest) was in fact acquired by the company’s controlling shareholder

- The subsidiary became a “connected subsidiary” for the loan agreements (Rule 14A.16)

- Those directors were aware of the acquisition; but did not take steps to alert the relevant department. The company’s internal procedures for connected transactions were not triggered

- The company failed to comply with the reporting, announcement, circular, and independent shareholders’ approval requirements for “connected transactions” (Chapter 14A)

- The company had a history of non-compliance with connected transactions rules

What you should do/watch out for:

- The approach taken by HKEX was in line with its revised enforcement policy

- Significance of repeated non-compliance by issuers, though some may be “minor” in isolation: (i) the appropriate regulatory message from non-compliance not recognised; (ii) there are internal control deficiencies; and/or (iii) there are misunderstandings by the directors of Listing Rule obligations

- Directors should have a full understanding of their obligations under the Listing Rules, to procure the company’s compliance. They should participate in continuous professional development

- The company is to appoint an independent adviser on compliance issues on an ongoing basis for 2 years; all directors to attend specified training on Listing Rules

- Internal controls: an independent adviser is to conduct a review and provide its findings and recommendations to HKEX. It will perform a follow-up assessment in the next 12 months as to the extent by which the company has (a) strengthened its internal controls and procedures to ensure Listing Rule compliance, and (b) followed the advisor’s recommendations