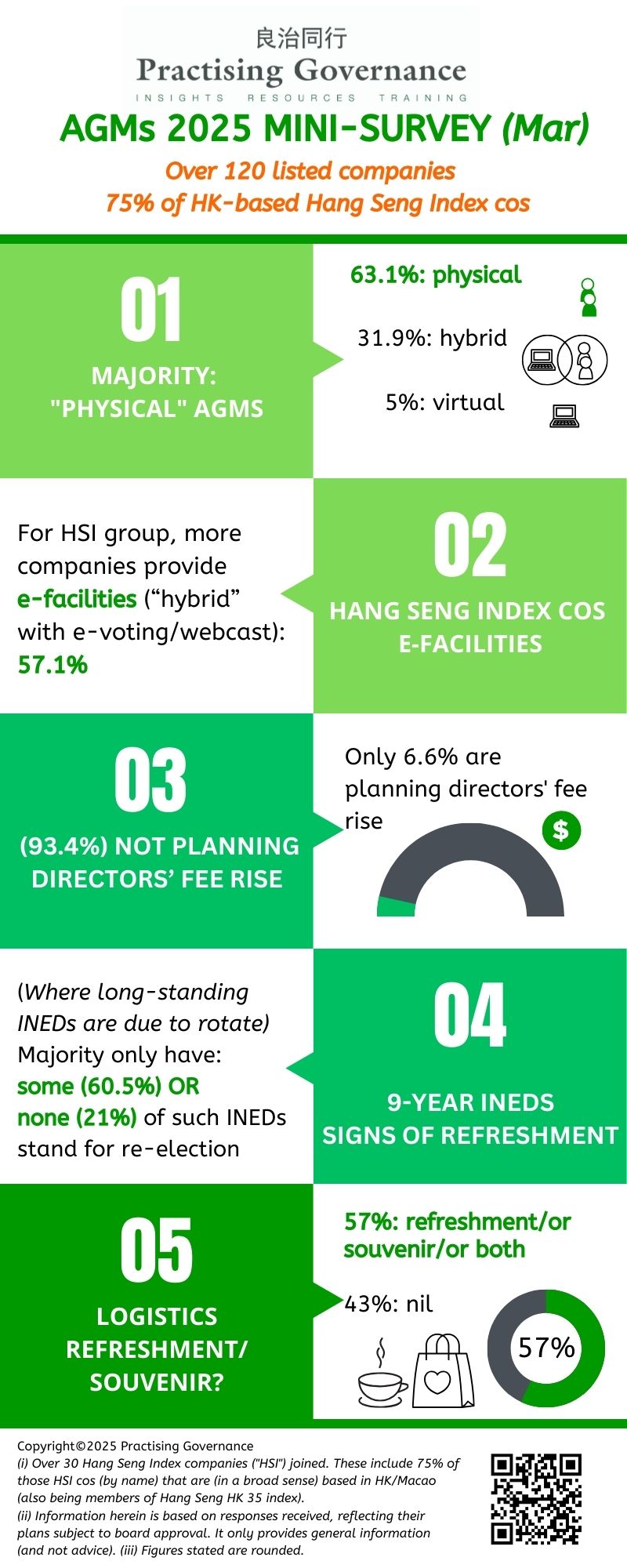

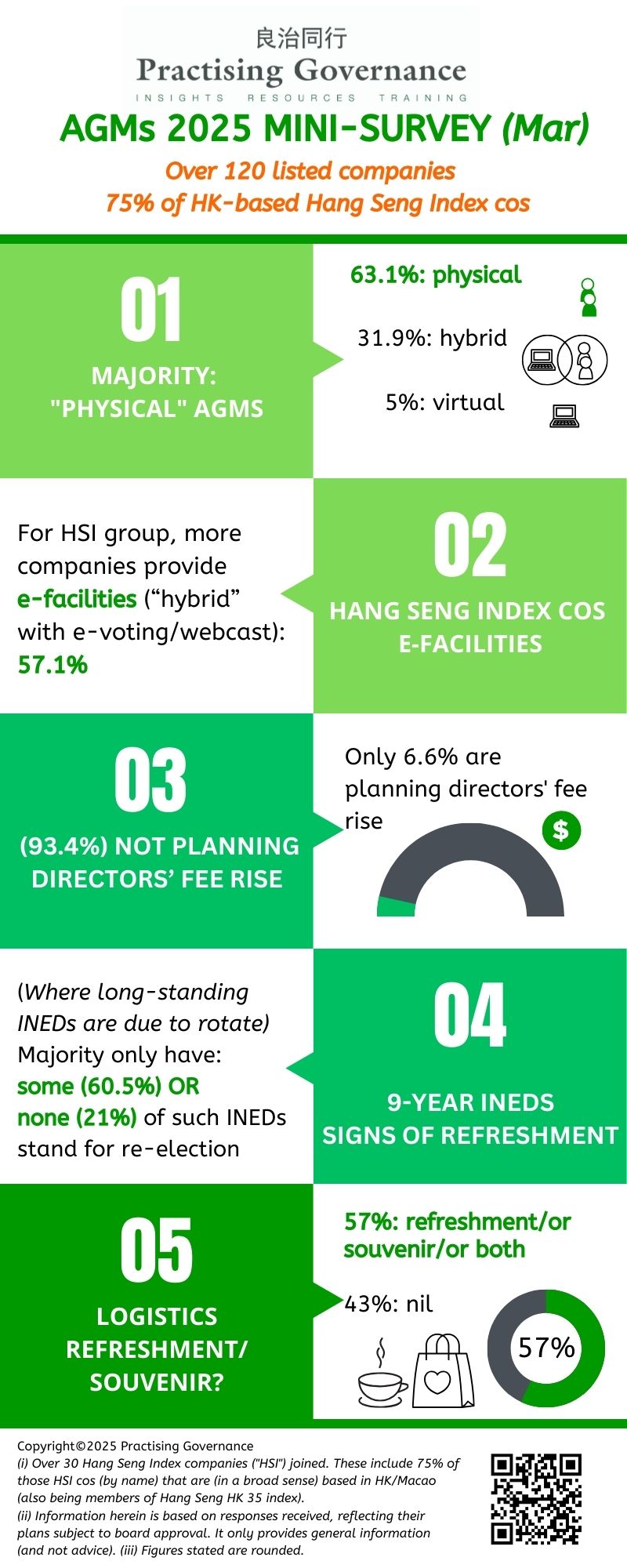

Mini survey on AGMs (2025)

This is our third AGM mini-survey, with support from our growing community. Over 120 listed companies joined our survey, with over 30 Hang Seng Index companies (including 75% of those based in HK/Macao).

Survey findings:

– Majority: “physical” meetings

– Many Hang Seng Index cos: “hybrid” meetings (e-voting OR webcast)

– Vast majority: NOT proposing director fee rise

– Signs of board refreshment: majority have only some/or none of 9-year INEDs standing for re-election

– Meeting logistics: majority have refreshment/or souvenir/or both

When compared with the last survey, signs of board refreshment continue to grow. In terms of meeting format, the majority plan to have physical meetings. However, Hang Seng Index companies show an increasing trend to go for “hybrid” meetings (with either e-voting or webcast).

Download Infographic